What is Long-Term Care and How Does it Fit into Your LGBT Family?

You probably know someone who has needed long-term care. Maybe you have witnessed your partner, friend or colleague struggle with the emotional and financial issues that can come with a long-term care experience. The truth is, no matter when the need arises, because of age, disability, or because of an unexpected illness or accident, long-term care can affect any age group, any social strata, and any geographic location. But what is it and how can you plan for it?

What is Long-Term Care?

Long-term care is help you may need due to a lengthy illness, an unexpected injury or accident, or a severe cognitive disorder such as Alzheimer’s disease. It’s assistance with the everyday tasks, or the activities of daily living (such as bathing, eating, dressing and transferring). Long-term care may be provided in a variety of locations, from nursing homes and assisted living facilities to adult day care centers and even your own home.

Who needs Long-Term Care?

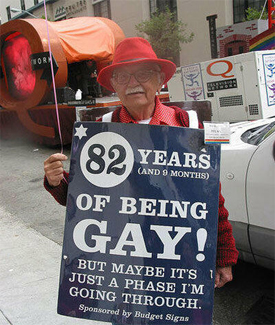

Most of us strive to live active, healthy lives well into our later years, and indeed as a society, Americans are living longer than ever before. This extended longevity is one of the things that drives the growing need for long-term care – the longer we live, the better the odds that we may need long-term care services. It is predicted that in the year 2020, some 12 million older Americans are expected to need long-term care. Given the fact that many LGBT persons tend to age alone, long term care is more important than ever before.

Who pays for Long-Term Care?

Long-term care can be expensive, financially and emotionally. An unexpected need for long-term care can have a significant impact on a family’s assets and lifestyle. Close to one-fourth of all nursing home costs are paid out-of pocket by individuals and their families.

Many people mistakenly believe that their health insurance will cover the cost of long-term care. Others believe that Medicare or Medicaid will cover long-term care expenses. While Medicare does provide health coverage for seniors, it is limited in the coverage it provides for long-term care. Medicaid will pay for the cost of long-term care, but you must qualify by meeting strict income and asset eligibility requirements.

Long-term care insurance could be a solution.

Long-term care insurance can be a very smart way to address the challenges from a long-term care need. Long-term care insurance can help pay for nursing home care, as well as, a variety of home and community based care services. Long-term care insurance may not be for everybody, so if you are considering a policy, read it carefully and be sure to work with an insurance agent who understands long-term care issues.

With long life comes long-term planning. Make a plan for you and your family today. For more information on long-term care insurance, please contact Mary L. Stockton, Agent, Stockton Financial and Insurance Services, 858-623-8945.

Information published on The Rainbow Babies website is not a substitute for proper medical advice, diagnosis, treatment or care. Always seek the advice of a physician or other qualified health providers with any questions you may have regarding a medical condition.

Disclaimer: The Rainbow Babies provides sample contracts and legal/social health articles for informational purposes only—please do not consider it as legally-binding advice of any kind.